We work with amazing companies

Creators of Revenue Lifecycle Management (RLM), Conga helps companies grow, protect, and expand their revenue—today and tomorrow.

The world’s growth champions trust Conga

More than 10,000 companies and 6.4 million users around the world use Conga to gain a Revenue Advantage. Our open RLM platform helps them grow faster and more efficiently and improve their customer experience.

Goodbye friction. Hello Revenue Advantage

Isolated tech, fragmented data, and siloed problem-solving traps companies in the Revenue Friction Zone. With a unified revenue data model, Conga helps teams answer their most complicated revenue questions.

Gain a Sales Advantage

Where is your forecast at risk? Which accounts are best suited for cross-sell or up-sell? Are you maximizing price increases with current contracts?

Gain a Finance Advantage

Which products and segments are most profitable? Where do you have renewal risk? Where should you invest or pull back on capital allocations?

Gain a Legal Advantage

What risks do you have across your contracts? How do you achieve compliance without slowing down sales? What’s the financial value of your risk?

Gain an IT Advantage

Is your data governed, secure, and AI-ready? How do you get out of integration purgatory and lower costs? How do you reduce your backlog?

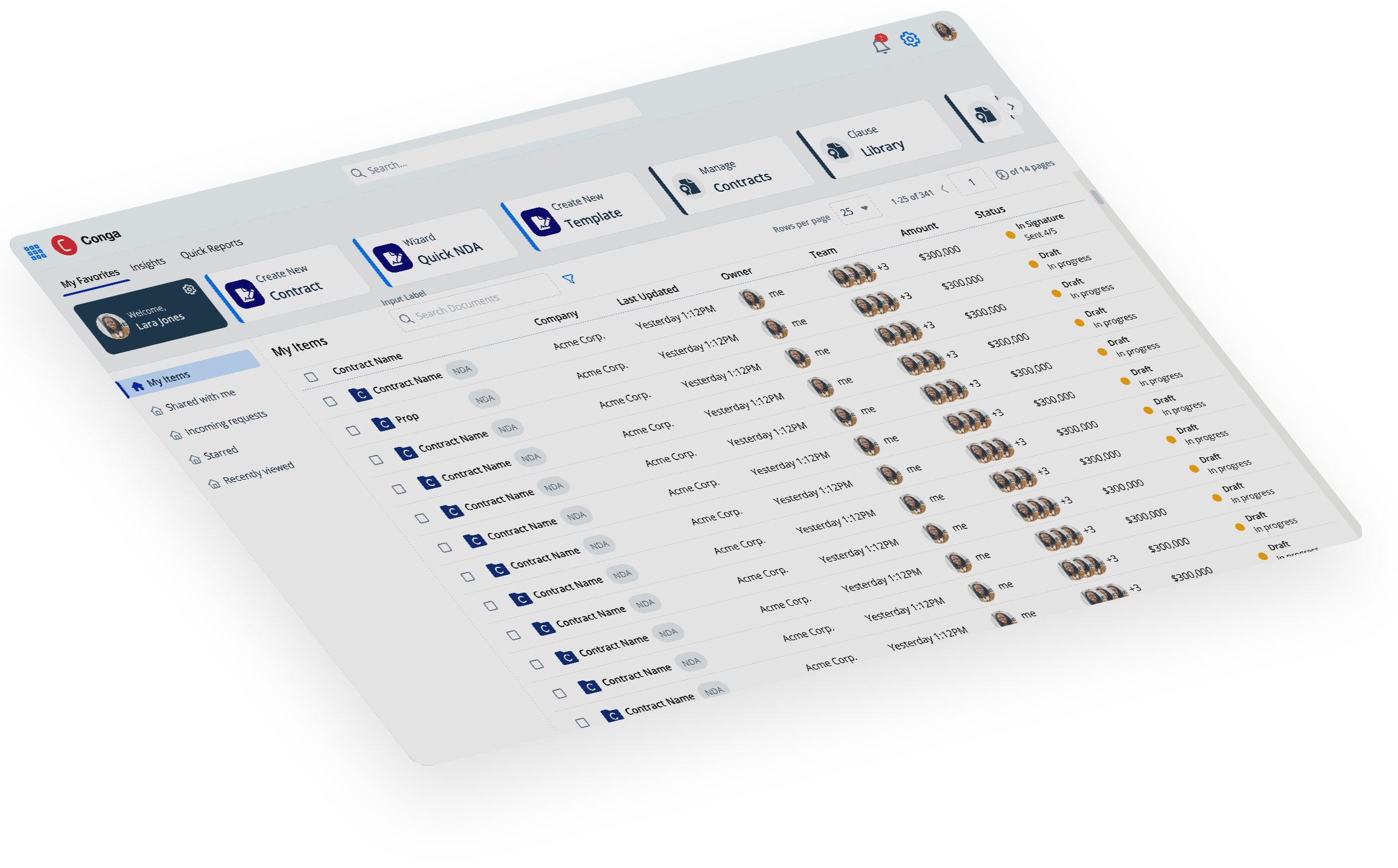

Conga’s open RLM platform

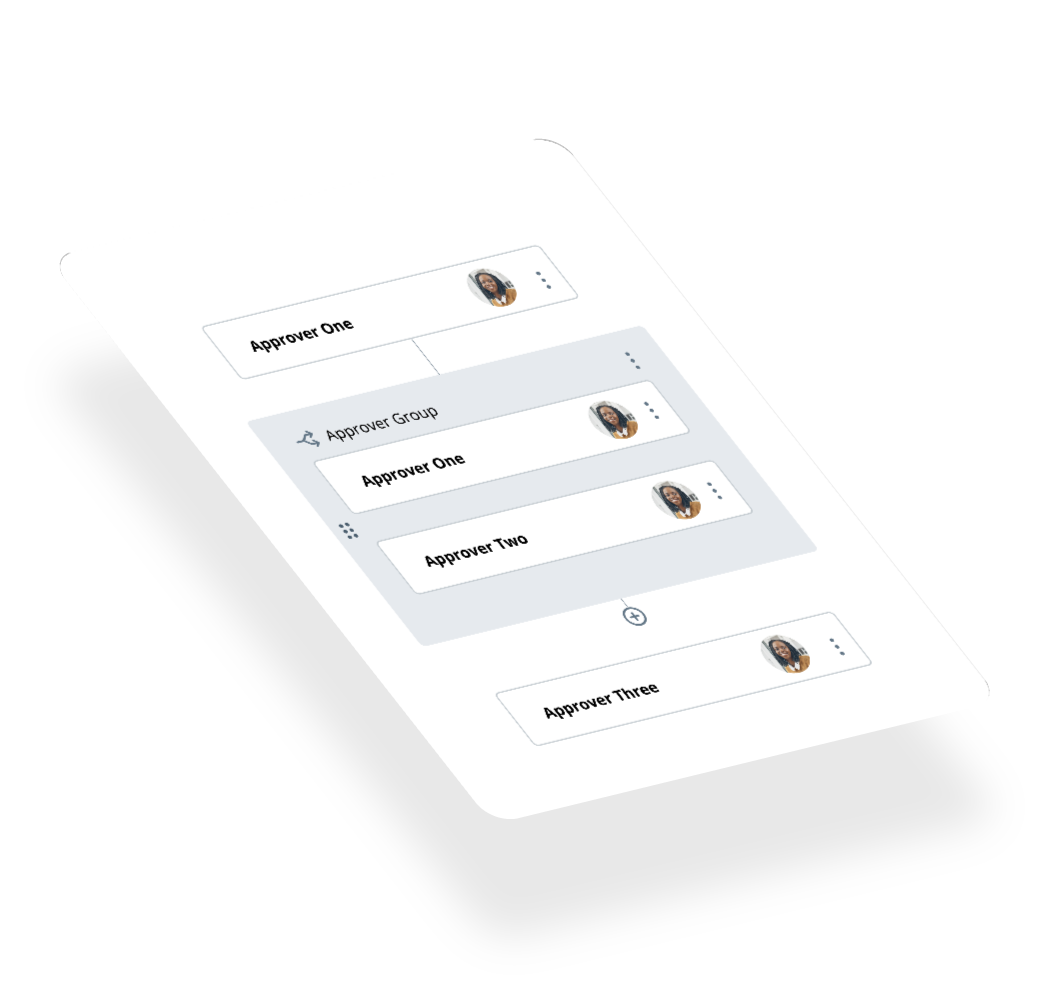

Configure, Price, Quote; Contract Lifecycle Management; and Document Automation together on a single open platform. Powered by a unified revenue data model, complete revenue intelligence, and purpose-built AI to help answer your most complex revenue questions.

See what our customers are saying

Product Reviews by Product

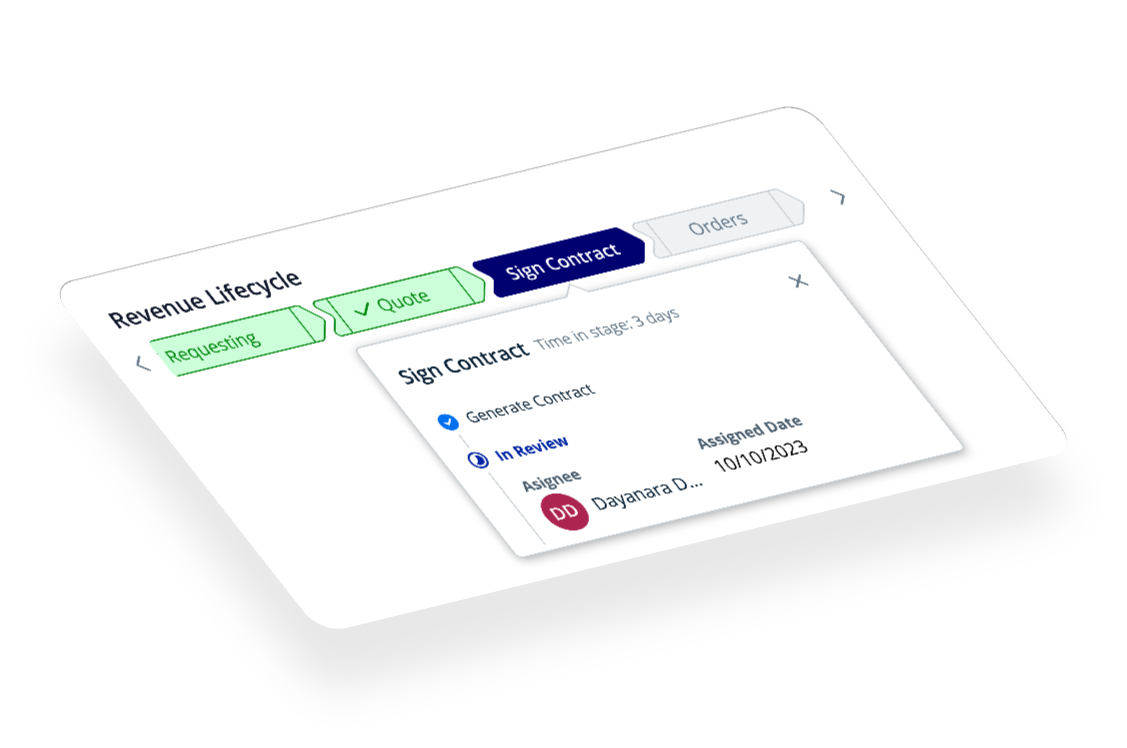

See how it works

End-to-end process integration and complete revenue intelligence across the revenue lifecycle. Conga is the only open revenue management platform built for the top line.